Reach higher tiers with Status Lift

With Status Lift, you can travel from Teal to Silver and beyond, with or without flying. Climb higher with everyday purchases on the WestJet RBC® World Elite Mastercard‡.6

What is Status Lift

Reach new heights with or without flying

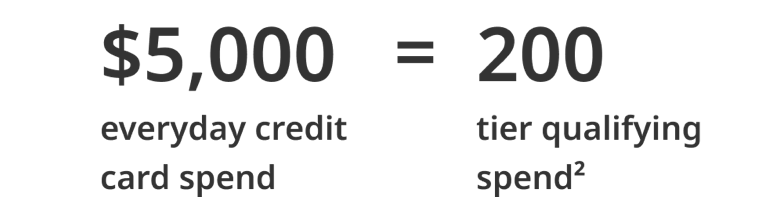

Get closer to higher status and greater rewards with the new and improved Status Lift. Now, you’ll receive a Status Lift every time you reach $5,000 in everyday spend on your WestJet RBC World Elite Mastercard account.6

With each Lift you’ll receive a 200 CAD boost to your tier qualifying spend. You can achieve up to 50 Lifts each calendar year – enough to reach Silver, Gold or even Platinum status.

What is Tier Qualifying Spend

Boost your tier qualifying spend with Status Lift

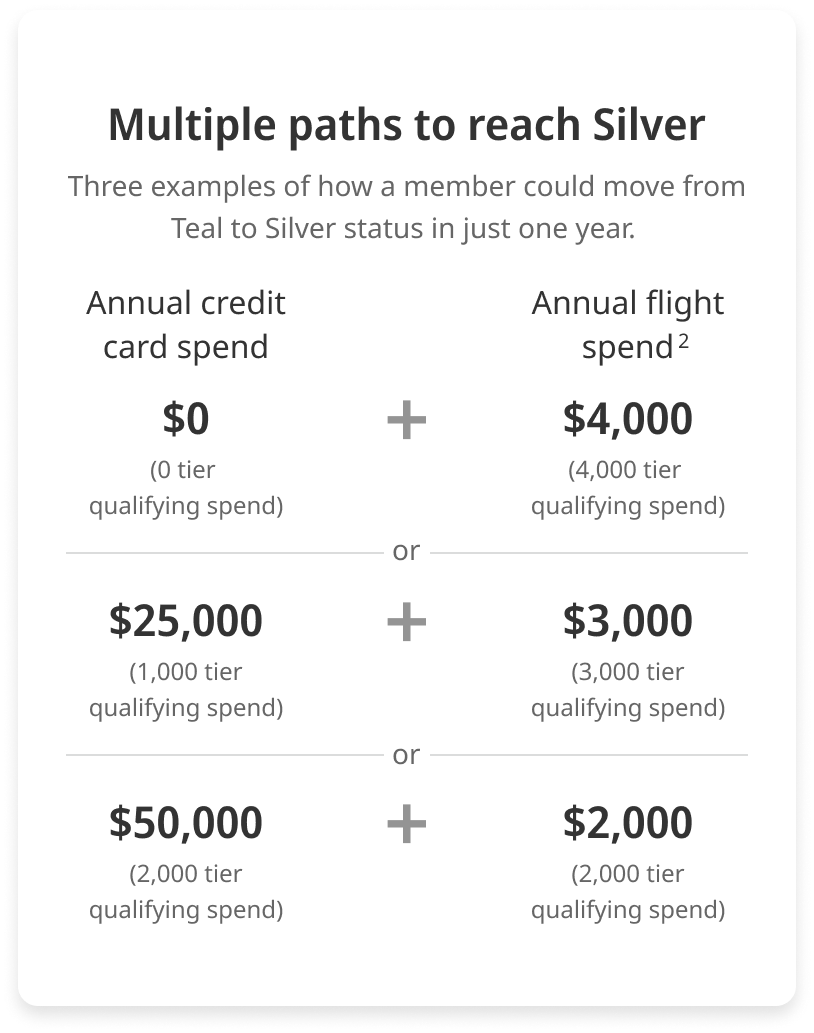

Tier qualifying spend tracks your progress towards achieving Silver, Gold or Platinum status each calendar year. A combination of Status Lift and individual spend is the most effective way to achieve the next tier.

View a breakdown of your tier qualifying spend under your account profile.

Will purchases made earlier this year count?

Yes, we’ve got you covered. Any eligible purchases made on your WestJet RBC World Elite Mastercard this year will count towards the new Status Lift.6

Your spending between Jan 1 and Apr 30, 2025 has been recalculated using the new Status Lift formula.6 This recalculation can only increase your potential for more Lifts. If you qualify, we’ll issue a one-time credit and the additional tier qualifying spend will be automatically added to your account.6

Enjoy more benefits as you climb higher

With Status Lift, higher tiers are within reach. As you climb, you'll unlock new benefits like greater earn rates for WestJet points, complimentary cabin upgrades and access to more priority services.

Teal

up to $3,999

Silver

$4,000 - $5,999

Gold

$6,000 - $9,999

Platinum

$10,000 and beyond

Looking to give your status a lift?

Go further, faster with a WestJet RBC World Elite Mastercard credit card. You’ll get closer to status with every purchase.6